In the ever-evolving landscape of cryptocurrency, a new player has emerged that is redefining the concept of asset ownership – Crypto Security Tokens. This blog post will explore the ins and outs of this revolutionary technology, from understanding what Crypto Security Tokens are to delving into how they work. We will also discuss the numerous benefits that come with utilizing Crypto Security Tokens, as well as the legal and regulatory considerations that must be taken into account when dealing with these digital assets. Finally, we will take a look at the future of asset ownership with Crypto Security Tokens, and how they are set to change the game. So, if you’ve been curious about this new wave of digital ownership and want to better comprehend its implications, this post is for you. Stay tuned as we uncover the potential of Crypto Security Tokens and their impact on the world of asset ownership.

What are Crypto Security Tokens?

Crypto security tokens are a type of cryptocurrency that represents a share in a company or real assets, such as real estate or art. These tokens are created and traded on blockchain platforms, using smart contracts to automate the processes of issuance, transfer, and redemption. Unlike utility tokens, which are used to access a company’s product or service, security tokens are subject to securities regulations.

One of the key features of crypto security tokens is their ability to provide fractional ownership of traditionally illiquid assets. This means that investors can own a fraction of high-value assets, such as real estate, without having to purchase the entire property. Additionally, by using blockchain technology, security tokens can offer greater transparency and accessibility, allowing for efficient and secure ownership of assets.

Another important aspect of crypto security tokens is their compliance with regulatory requirements. By representing ownership of real assets, security tokens are subject to securities laws and regulations, which can vary by jurisdiction. This means that issuers and investors must adhere to specific requirements, such as conducting know-your-customer (KYC) and anti-money laundering (AML) checks.

In summary, crypto security tokens are a new form of digital asset that represents ownership in real assets, such as company shares or real estate. They offer fractional ownership, compliance with securities regulations, and the potential for increased liquidity and accessibility.

How Crypto Security Tokens Work

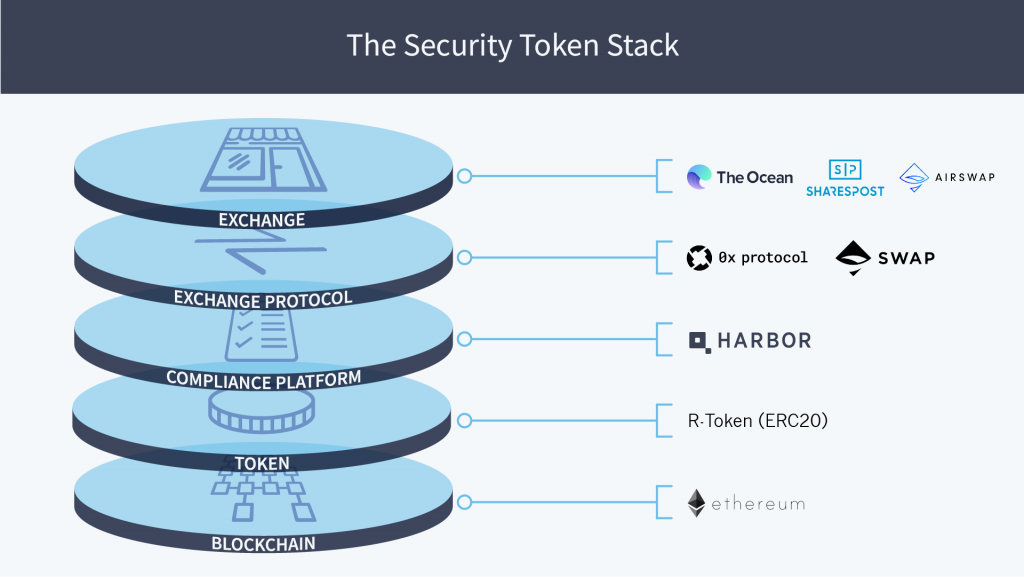

Crypto security tokens are a type of digital asset that represent ownership of an underlying asset, such as real estate, company shares, or artwork. They work by using blockchain technology to create a secure and transparent record of ownership and transfer. Each token is unique and has a corresponding digital signature, making it virtually impossible to counterfeit or tamper with.

When an investor purchases a crypto security token, they are issued a digital certificate of ownership, which is recorded on the blockchain. This allows for the seamless transfer of ownership and eliminates the need for intermediaries, such as banks or brokers. Smart contracts are often used to automate the transfer and disbursement of dividends or profits, further streamlining the process.

One of the key features of crypto security tokens is their compliance with securities regulations. By programming the tokens to adhere to securities laws, issuers can ensure that they are accessible to a wider pool of investors and can be traded on regulated platforms. This level of compliance provides confidence to investors and helps to mitigate the risk of fraud or market manipulation.

Overall, the use of crypto security tokens offers a more efficient and transparent way to represent ownership of assets. By leveraging blockchain technology and smart contracts, these tokens provide a secure and compliant method for issuing, transferring, and trading securities, ultimately reshaping the way we think about asset ownership.

The Benefits of Crypto Security Tokens

Crypto security tokens offer a wide range of benefits to both investors and issuers. One of the primary advantages is the increased efficiency and liquidity they bring to the market. Unlike traditional securities, crypto security tokens can be traded 24/7, allowing for greater flexibility and access for investors around the world. This also leads to reduced settlement times and lower transaction costs, making it easier for issuers to raise capital and for investors to diversify their portfolios.

Another key benefit of crypto security tokens is the potential for fractional ownership. This means that investors can purchase smaller portions of an asset, allowing for greater accessibility and affordability. Additionally, crypto security tokens provide improved transparency and security through the use of blockchain technology, reducing the risk of fraud and unauthorized transactions.

Furthermore, crypto security tokens offer increased opportunities for automation and programmable features. Smart contracts can be implemented to automatically execute specific conditions, such as dividend payments or voting rights, without the need for intermediaries. This not only streamlines processes but also enhances trust and accountability within the ecosystem.

Overall, the benefits of crypto security tokens are clear – from enhanced efficiency and liquidity to fractional ownership and improved security, they represent a significant advancement in the world of securities.

Legal and Regulatory Considerations for Crypto Security Tokens

When it comes to crypto security tokens, there are several legal and regulatory considerations that need to be taken into account. One of the most important factors is ensuring compliance with securities laws in the jurisdictions in which the tokens are being offered or traded. This includes understanding the definition of a security and ensuring that the tokens meet the criteria to be classified as such.

Additionally, it’s crucial to consider the implications of anti-money laundering (AML) and know your customer (KYC) regulations. These regulations are in place to prevent money laundering and terrorist financing, and companies offering or trading security tokens must ensure that they are in compliance with these laws.

Another important consideration is the potential for taxation of security tokens. Depending on the jurisdiction, the tokens may be subject to capital gains tax, income tax, or other forms of taxation. Understanding the tax implications of security tokens is crucial for both issuers and investors.

Finally, companies must also consider the impact of international regulations on security tokens. The global nature of blockchain technology means that security tokens may be offered or traded across borders, and companies must ensure compliance with the laws of multiple jurisdictions.

The Future of Asset Ownership with Crypto Security Tokens

Crypto security tokens are changing the way people view and manage their assets. As we move towards a more digital age, the idea of owning tangible assets is evolving. No longer do investors need to physically hold their assets, thanks to the rise of crypto security tokens. These tokens represent ownership of real-world assets such as real estate, art, or even stocks, but in a digital format. This shift in ownership has the potential to revolutionize the way we invest and manage our assets.

One of the benefits of using crypto security tokens for asset ownership is the increased accessibility they provide. In the traditional financial system, investing in certain assets may be restricted to accredited investors or require significant capital. However, with crypto security tokens, fractional ownership becomes a more viable option, allowing a larger pool of investors to participate in asset ownership. This opens up opportunities for a more diverse range of individuals to invest in assets that were previously out of reach.

Another aspect of the future of asset ownership with crypto security tokens is the potential for increased liquidity. Traditional assets such as real estate or private equity can be illiquid, meaning it can be difficult to buy or sell ownership stakes quickly. However, by using crypto security tokens, these assets can be tokenized and traded on digital asset exchanges, potentially increasing liquidity and providing more flexibility for investors.

Furthermore, the ability to offer programmable features within these tokens opens up new possibilities for asset ownership. Smart contracts can be used to automate various aspects of ownership, such as dividend distributions or voting rights. This level of automation and customization has the potential to streamline the process of asset ownership and create new opportunities for investors.

Frequently Asked Questions

What are Crypto Security Tokens?

Crypto security tokens are digital representations of real-world assets, such as stocks, real estate, or commodities, that are issued and traded on a blockchain. These tokens provide investors with a more efficient and transparent way to own and trade traditional assets.

How do Crypto Security Tokens Work?

Crypto security tokens are created through the process of tokenization, where the ownership of an asset is divided into digital tokens and recorded on a blockchain. These tokens can then be bought, sold, and traded on digital asset exchanges, allowing for fractional ownership and more accessible investment opportunities.

What are the Benefits of Crypto Security Tokens?

Some of the benefits of crypto security tokens include increased liquidity, lower barriers to entry for investors, reduced transaction costs, and 24/7 market access. Additionally, the use of blockchain technology provides enhanced security, transparency, and trust in the ownership and transfer of assets.

What are the Legal and Regulatory Considerations for Crypto Security Tokens?

The issuance and trading of crypto security tokens are subject to various legal and regulatory requirements, including securities laws, anti-money laundering (AML) regulations, and know-your-customer (KYC) procedures. It’s important for issuers and investors to comply with these regulations to ensure the legitimacy and legality of their tokenized assets.

What is the Future of Asset Ownership with Crypto Security Tokens?

The future of asset ownership with crypto security tokens is promising, as it offers a more inclusive and efficient way to invest in traditional assets. As blockchain technology continues to evolve and regulatory frameworks become more established, we can expect to see a wider range of assets being tokenized and traded on decentralized platforms.