Are you interested in getting started with crypto trading but don’t know where to begin? The world of cryptocurrencies and blockchain technology can be overwhelming for beginners, but with the right knowledge and strategies, you can navigate this exciting and potentially lucrative market. In this blog post, we will break down the essential steps and techniques for beginner crypto traders. From understanding the fundamentals of cryptocurrencies and blockchain technology to setting up a trading account and choosing the right assets to trade, we will cover everything you need to know to start your crypto trading journey. Additionally, we will discuss basic technical analysis and the importance of implementing risk management strategies to help you make informed trading decisions. Whether you’re new to trading or looking to expand your investment portfolio, these tips and strategies will set you on the right path in the world of crypto trading.

Understanding Cryptocurrencies and Blockchain Technology

Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate independently of a central bank. They are decentralized and typically use blockchain technology to secure transactions and control the creation of new units. This means that cryptocurrencies are not controlled by any single entity or government, making them immune to interference or manipulation.

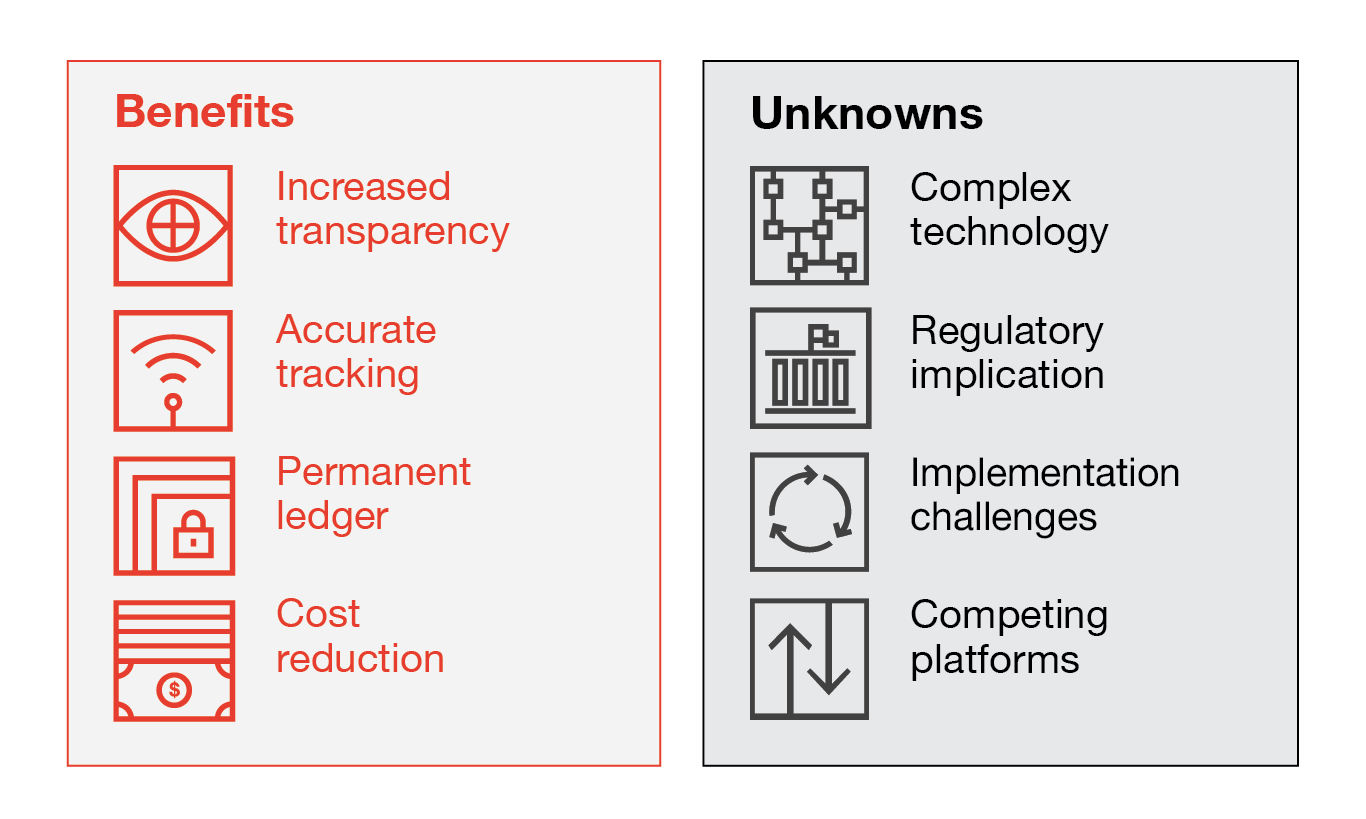

Blockchain technology is the underlying technology that powers cryptocurrencies. It is a distributed ledger that records all transactions across a network of computers. Each block in the chain contains a list of transactions, and once a block is completed, it is added to the chain in a permanent and unalterable way. This makes blockchain technology secure, transparent, and resistant to fraud.

One of the key features of blockchain technology is its transparency. All transactions are recorded on the blockchain and can be viewed by anyone. This transparency is one of the reasons why blockchain technology is considered to be revolutionary, as it has the potential to transform industries beyond just finance.

Understanding cryptocurrencies and blockchain technology is crucial for anyone looking to get involved in the world of crypto trading. It’s important to have a solid grasp of the fundamentals before diving into the complexities of trading and investing in cryptocurrencies.

Setting Up a Crypto Trading Account

Setting up a crypto trading account can be an exciting but daunting task, especially for beginners. There are several steps to take in order to get started in the world of cryptocurrency trading. The first step is to choose a reliable and reputable exchange platform to create an account with. It’s important to thoroughly research the different platforms available and compare factors such as fees, security measures, and user interface.

Once you have chosen an exchange, the next step is to sign up and verify your identity. Depending on the platform, this process may involve providing personal information and documents to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. After your identity is verified, you can proceed to fund your account with fiat currency or other cryptocurrencies.

After funding your account, you will need to set up a secure wallet to store your cryptocurrencies. Many exchange platforms offer built-in wallets, but it’s often recommended to use an external wallet for added security. Research different wallet options and choose one that best fits your needs.

Finally, it’s important to enable security features such as two-factor authentication (2FA) to protect your account from unauthorized access. Once your account is set up and secure, you can start exploring the world of crypto trading.

Choosing the Right Cryptocurrencies to Trade

When it comes to choosing the right cryptocurrencies to trade, it’s important to consider a few key factors. One of the most important factors to consider is the potential for growth. You’ll want to look for cryptocurrencies that have a strong track record of growth, as well as those that have the potential for future growth.

Another important factor to consider is the volatility of the cryptocurrency. While volatility can lead to big gains, it can also lead to big losses. It’s important to carefully consider the volatility of a cryptocurrency before deciding to trade it.

Security is also a crucial consideration when choosing cryptocurrencies to trade. You’ll want to ensure that the cryptocurrency you choose to trade is secure and has a strong reputation for security. This will help to protect your investment and reduce the risk of theft or loss.

Lastly, it’s important to consider the liquidity of the cryptocurrency. Liquidity refers to how easily a cryptocurrency can be bought or sold without causing a significant change in its price. Choosing a cryptocurrency with high liquidity can help to ensure that you’ll be able to easily buy and sell your investment when you need to.

Basic Technical Analysis for Crypto Trading

When it comes to crypto trading, understanding basic technical analysis can be incredibly helpful. Technical analysis involves studying historical price and volume data to identify patterns and trends. One common tool used in technical analysis is the moving average, which helps traders smooth out price data to identify trends over a specific period of time.

Another important concept in technical analysis is support and resistance levels. These are price levels at which a particular cryptocurrency tends to stop falling or rising. By identifying these levels, traders can make more informed decisions about when to buy or sell.

One key indicator that traders often use in technical analysis is the relative strength index (RSI). The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions in a particular cryptocurrency. This can help traders identify potential reversal points in the market.

Additionally, understanding chart patterns such as head and shoulders, triangles, and double tops and bottoms can provide valuable insights for traders. By recognizing these patterns, traders can anticipate potential price movements and make well-informed trading decisions.

Implementing Risk Management in Crypto Trading

When it comes to crypto trading, it’s important to understand the risks involved and how to manage them effectively. One of the key ways to do this is by implementing risk management strategies to protect your investments and minimize potential losses.

One way to implement risk management in crypto trading is by setting stop-loss orders. This involves setting a predetermined price at which you would sell your cryptocurrency in order to limit potential losses. By setting stop-loss orders, you can protect your investments from significant downturns in the crypto market.

Another important aspect of risk management in crypto trading is diversification. This means spreading your investments across different cryptocurrencies to reduce the impact of a single cryptocurrency’s price fluctuations on your overall portfolio. Diversification can help mitigate risk and protect your investments from significant losses.

Additionally, it’s important to stay informed about market trends and news that could impact the crypto market. By staying updated on industry developments, regulatory changes, and other factors that could affect cryptocurrency prices, you can make informed decisions and minimize the impact of unexpected events on your crypto trading investments.

Frequently Asked Questions

What are cryptocurrencies and blockchain technology?

Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate on decentralized networks based on blockchain technology. Blockchain is a distributed ledger that records all transactions across a network of computers.

How do I set up a crypto trading account?

To set up a crypto trading account, you need to choose a reputable cryptocurrency exchange, complete the registration process, and verify your identity. Once your account is verified, you can fund it with fiat currency or other cryptocurrencies to start trading.

What are the factors to consider when choosing the right cryptocurrencies to trade?

When choosing cryptocurrencies to trade, consider their market liquidity, trading volume, price volatility, and fundamental technology and use case. It’s important to research and analyze the potential of each cryptocurrency before investing.

What is basic technical analysis for crypto trading?

Basic technical analysis for crypto trading involves analyzing price charts, identifying trends and patterns, and using technical indicators to make informed trading decisions. It helps traders forecast potential price movements based on historical market data.

How can I implement risk management in crypto trading?

Implementing risk management in crypto trading involves setting stop-loss and take-profit orders, diversifying your trading portfolio, and avoiding emotional trading decisions. It’s important to manage risk and protect your capital from significant losses.

What are some common crypto trading strategies for beginners?

Common crypto trading strategies for beginners include HODLing (buy and hold), swing trading, day trading, and trend following. Each strategy has its own risk-reward profile and requires careful planning and execution.

Where can I find reliable resources to learn more about crypto trading?

You can find reliable resources to learn more about crypto trading on reputable cryptocurrency websites, online forums, educational courses, and trading platforms. It’s essential to stay informed and continuously improve your knowledge and skills in crypto trading.