In recent years, the rise of cryptocurrency has become a hot topic in the world of investing. As traditional markets continue to fluctuate, more and more investors are looking to diversify their portfolios with crypto assets. But what exactly are crypto assets, and how can they add value to your investment strategy? In this blog post, we will explore the concept of crypto assets and their potential benefits in diversifying your portfolio. We will also discuss the important factors to consider when choosing the right mix of crypto assets, as well as how to evaluate and manage the associated risks. Additionally, we’ll delve into the significance of tracking and adjusting your crypto asset portfolio to ensure a well-balanced and successful investment approach. Whether you are new to the world of cryptocurrency or a seasoned investor, understanding the role of crypto assets in diversifying your portfolio is crucial in today’s dynamic investment landscape.

Understanding crypto assets and their value

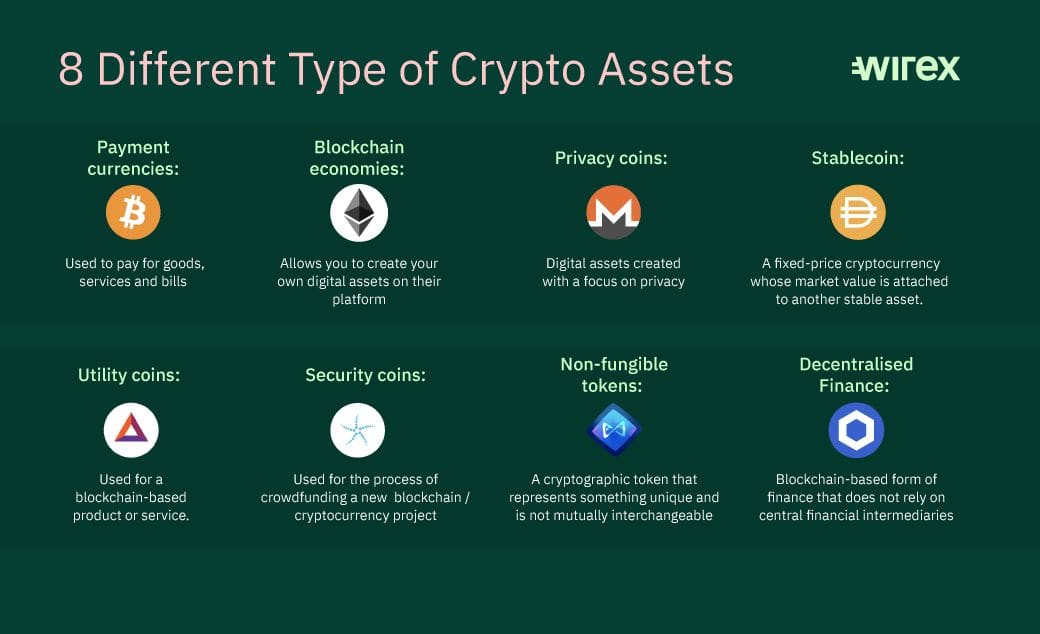

When it comes to crypto assets, it’s important to have a clear understanding of their value and the factors that contribute to it. Crypto assets are digital or virtual assets that are encrypted and secured through blockchain technology. These assets can take various forms, including cryptocurrencies like Bitcoin and Ethereum, as well as digital tokens and other blockchain-based assets. Their value is derived from factors such as scarcity, utility, demand, and market sentiment.

Scarcity plays a significant role in determining the value of crypto assets. Many cryptocurrencies are designed with a limited supply, which can create scarcity and drive up their value. For example, Bitcoin has a maximum supply of 21 million coins, which contributes to its perceived value as a store of value. Additionally, the utility of a crypto asset can impact its value. Assets that have real-world applications and are used for various purposes within decentralized applications or platforms may be seen as more valuable.

Furthermore, demand and market sentiment play a crucial role in determining the value of crypto assets. When there is high demand for a particular asset, its price tends to increase. Market sentiment, such as investor confidence and perception of future price movements, also influences the value of crypto assets. Understanding these factors is essential for investors to make informed decisions when buying, selling, or holding crypto assets.

In conclusion, understanding the value of crypto assets requires a grasp of their scarcity, utility, demand, and market sentiment. As the crypto market continues to evolve, having a thorough understanding of these factors can help investors navigate the complexities of this asset class and make strategic investment decisions.

Identifying the benefits of diversification

Diversification is a strategy that involves spreading your investments across different crypto assets in order to reduce risk. It is based on the idea that a diversified portfolio will have better long-term performance, as losses in one asset can be offset by gains in another. By diversifying your crypto holdings, you can potentially protect yourself against the volatility of individual assets.

One of the main benefits of diversification is the potential for higher returns. By investing in a variety of crypto assets, you can capture the upside potential of different markets and assets, which can lead to better overall performance. Diversification also allows you to spread your risk across different cryptocurrencies and tokens, which can help protect your portfolio from significant losses.

Another benefit of diversification is the ability to hedge against specific market risks. By investing in a mix of crypto assets with different correlation, you can reduce the impact of downturns in any one asset or market. This can help to mitigate the risk of large losses, while still allowing you to capture the potential gains of other assets.

Furthermore, diversification can also help to reduce the overall volatility of your crypto portfolio. By investing in a variety of assets with different risk profiles, you can smooth out the peaks and valleys of your portfolio’s performance. This can provide a more stable and predictable return over time, as the performance of one asset is less likely to significantly impact the overall performance of your portfolio.

Choosing the right mix of crypto assets

When it comes to investing in crypto assets, choosing the right mix is crucial for success. With so many cryptocurrencies available, it can be overwhelming to decide which ones to include in your portfolio. It’s important to consider a variety of factors, including risk tolerance, investment goals, and market conditions.

One strategy for choosing the right mix of crypto assets is to diversify across different types of cryptocurrencies. This can help spread risk and reduce the impact of market volatility. For example, you might consider including a mix of large-cap, mid-cap, and small-cap coins in your portfolio. Additionally, you may want to include a mix of established cryptocurrencies and newer, up-and-coming coins.

Another important consideration when choosing the right mix of crypto assets is to stay informed about market trends and developments. This can help you identify opportunities for including new cryptocurrencies in your portfolio, as well as making adjustments to your existing holdings. It’s also important to evaluate the potential for growth and stability of each crypto asset before including it in your mix.

Ultimately, the right mix of crypto assets will be unique to each investor and their specific financial circumstances. By carefully considering factors such as diversification, market trends, and growth potential, investors can make informed decisions about which cryptocurrencies to include in their portfolios.

Evaluating and managing risk in your portfolio

When it comes to managing a crypto asset portfolio, one of the most important factors to consider is the level of risk involved. Evaluating and managing risk in your portfolio requires a deep understanding of the market, the assets you hold, and the potential for volatility. Without a proper risk management strategy, you could be exposing yourself to unnecessary losses.

One way to evaluate risk in your portfolio is by conducting a thorough analysis of each crypto asset you hold. This includes understanding the underlying technology, the team behind the project, and the market dynamics that could affect its value. By identifying the potential risks associated with each asset, you can make more informed decisions about how to manage and mitigate those risks.

Another important aspect of managing risk in your portfolio is diversification. By spreading your investments across a variety of crypto assets, you can reduce the overall risk of your portfolio. Diversification can help to protect you from significant losses if one particular asset underperforms, while still allowing you to benefit from the potential upside of other assets.

Finally, ongoing evaluation and adjustment of your crypto asset portfolio is crucial for managing risk effectively. Market conditions can change rapidly, and what may have been a low-risk investment yesterday could become much riskier today. By staying informed about market trends and being willing to make adjustments to your portfolio as necessary, you can ensure that your investments remain as secure as possible.

Tracking and adjusting your crypto asset portfolio

Tracking and adjusting your crypto asset portfolio is an essential part of investment management. In order to ensure that your portfolio is performing as expected and meeting your investment goals, it is important to regularly track the performance of your crypto assets. This can be done through technical analysis and fundamental analysis to evaluate the market trends and the intrinsic value of the assets.

Once you have tracked the performance of your crypto assets, it is important to adjust your portfolio accordingly. This may involve rebalancing your allocation of assets based on the changing market conditions and the evolving investment landscape. By adjusting your portfolio in response to market dynamics, you can optimize the risk-return profile of your investment and ensure that it remains in line with your financial objectives.

Furthermore, tracking and adjusting your crypto asset portfolio also involves staying informed about regulatory developments and industry trends that may impact the valuation and performance of crypto assets. This requires ongoing research and monitoring to stay ahead of the curve and make informed decisions about the composition of your portfolio.

In conclusion, tracking and adjusting your crypto asset portfolio is crucial for investment success. By staying proactive and responsive to market dynamics, you can maximize the value of your portfolio and mitigate the risks associated with crypto assets.

Frequently Asked Questions

What are crypto assets and their value?

Crypto assets are digital or virtual assets that use cryptography for security and are stored on a blockchain. Their value comes from their scarcity, utility, and demand in the market.

What are the benefits of diversifying your portfolio with crypto assets?

Diversifying with crypto assets can provide a hedge against traditional market volatility, offer potential for high returns, and access to new investment opportunities.

How do you choose the right mix of crypto assets for your portfolio?

Choosing the right mix involves considering factors such as the asset’s purpose, technology, market trends, and your risk tolerance. It’s important to research and diversify across different types of crypto assets.

How do you evaluate and manage risk in your crypto asset portfolio?

Risk evaluation involves assessing factors such as market volatility, security risks, and regulatory changes. Risk management includes setting clear investment goals, diversifying, and staying informed about the market.

What are some strategies for tracking and adjusting your crypto asset portfolio?

Strategies for tracking and adjusting include setting benchmarks, regularly reviewing your portfolio, rebalancing based on market conditions, and staying updated on industry news and developments.