Investing in health tech is not only a way to potentially earn passive income but also a means of supporting the advancement of technology in the healthcare industry. In this blog post, we will explore the different aspects of health tech investments, from understanding what they entail to identifying promising startups in this sector. We will also discuss the importance of diversifying your investment portfolio within health tech and maximizing your passive income. Additionally, we will delve into evaluating the potential risks associated with health tech investments, to ensure that you make informed decisions when entering this market. By the end of this post, you will have a clearer understanding of how to navigate the world of health tech investments and how it can be a profitable avenue for passive income.

Understanding health tech investments

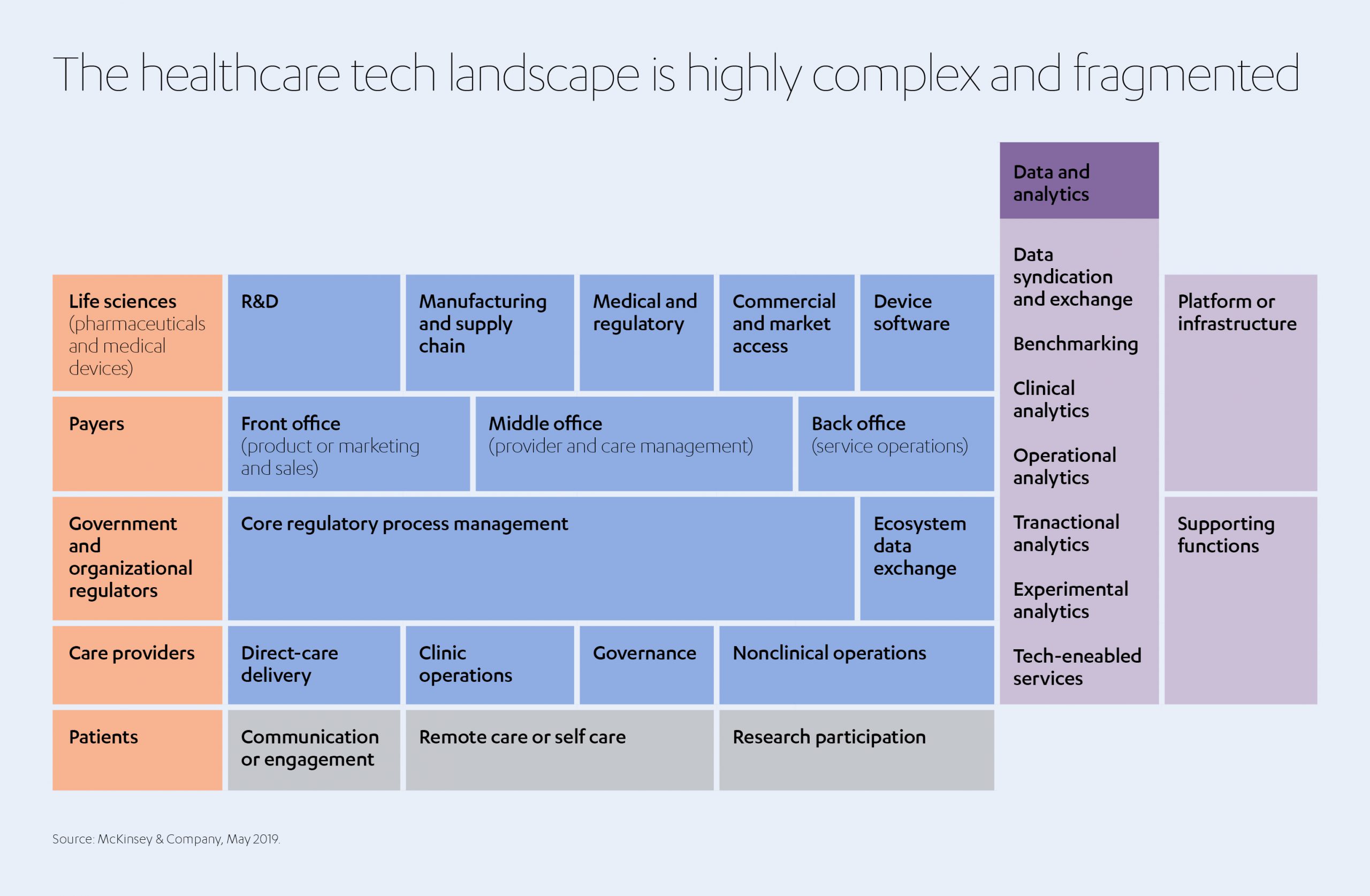

Health tech investments involve the funding of companies that are developing technology to improve healthcare delivery, patient outcomes, and overall efficiency in the healthcare industry. These investments can encompass a wide range of technologies, including telemedicine, electronic health records, wearable devices, and artificial intelligence.

Investors need to understand the potential impact of these technologies on the healthcare landscape and how they can contribute to cost savings, better patient care, and improved access to healthcare services.

It is essential to conduct thorough research into each health tech startup before making an investment. This includes understanding the technology they are developing, their target market, competitive advantages, and the experience of their leadership team.

Understanding the regulatory environment is also crucial, as compliance with healthcare regulations can significantly impact the success of a health tech company. Investors should be aware of the potential risks and challenges associated with navigating these regulations.

Identifying promising health tech startups

When it comes to investing in health tech startups, identifying the most promising ones is crucial for success. With the rapid advancement in technology, there is no shortage of health tech startups vying for investment. However, not every startup will go on to achieve success, making the process of identification all the more important.

One of the first steps in identifying promising health tech startups is to thoroughly research the market. Look for startups that are addressing a pressing need or solving a prominent issue within the healthcare industry. Whether it’s through innovative digital health solutions or healthcare software, the startup should have a clear value proposition and a unique approach.

Furthermore, it’s essential to evaluate the team behind the startup. Look for founders and leaders who have a successful track record in the health tech industry or possess relevant expertise that sets them apart. A strong, dedicated team is often indicative of a startup that has the potential to succeed.

Finally, consider the scalability and market potential of the health tech startup. Having a clear vision for growth and a strategy to penetrate various segments of the healthcare market is essential for long-term success. Look for startups that not only have a strong product or service but also a solid plan for growth and expansion.

Diversifying your health tech investment portfolio

When it comes to health tech investments, it’s important to look for opportunities that allow you to diversify your portfolio. Diversification is the key to minimizing risk and maximizing potential returns in any investment strategy. In the realm of health tech, this means spreading your investments across a range of promising startups and emerging technologies.

One way to diversify your health tech investment portfolio is to consider investing in various aspects of the healthcare industry, such as telemedicine, wearable health devices, and digital therapeutics. By spreading your investments across different sectors, you can reduce the impact of any single company’s performance on your overall portfolio.

Another strategy for diversifying your health tech investment portfolio is to look for opportunities in different geographic regions. The health tech industry is thriving in multiple countries around the world, each with its own unique set of innovative startups and technologies. By investing internationally, you can gain exposure to a wider range of opportunities and potentially tap into new markets.

Furthermore, consider diversifying the stage of startups in which you invest. While early-stage startups may offer high growth potential, later-stage companies may provide more stability and a proven track record. By investing in a mix of early-stage, mid-stage, and late-stage startups, you can balance risk and potential reward within your portfolio.

Maximizing passive income through health tech investments

Investing in health tech startups can be a lucrative way to generate passive income. With the growing demand for innovative healthcare solutions, the potential for high returns on investment is substantial. By diversifying your portfolio to include a range of health tech companies, you can maximize your passive income potential.

One strategy to maximize passive income through health tech investments is to identify startups that have a strong track record of growth and a clear path to scalability. This requires thorough research into the company’s leadership, market potential, and competitive advantages.

Additionally, it’s important to stay informed about the latest developments in the health tech industry. Keeping abreast of emerging trends and breakthrough technologies can help you spot promising investment opportunities. By staying ahead of the curve, you can position yourself to capitalize on the most innovative and game-changing startups.

Lastly, maximizing passive income through health tech investments requires a long-term mindset. While the potential for high returns is certainly appealing, it’s crucial to approach these investments with patience and a focus on sustainable growth. By carefully selecting and nurturing your portfolio of health tech startups, you can create a source of passive income that continues to grow and thrive over time.

Evaluating the potential risks of health tech investments

Investing in health tech companies can be a lucrative venture, but it also comes with its fair share of risks. Before diving into this market, it’s important to carefully evaluate and understand the potential risks involved. One of the primary risks of health tech investments is regulatory and compliance issues. The industry is highly regulated, and any changes in regulations or non-compliance can have a significant impact on the success of a company.

Another risk to consider is the competitive landscape. Health tech startups face stiff competition from established players as well as other startups. It’s crucial to assess whether a company has a unique offering that can withstand competition and market dynamics.

Financial risks are also a significant concern in health tech investments. Many companies in this sector require substantial capital to fund research and development, and there’s no guarantee of a return on investment. Market and technology risks are a reality in the ever-evolving health tech industry, and investors must carefully assess the potential for market adoption and technological obsolescence.

Overall, evaluating the potential risks of health tech investments requires a thorough understanding of the industry, market dynamics, and individual company factors. While there are undoubtedly opportunities for significant returns, it’s essential to approach these investments with caution and a keen awareness of the risks involved.

Frequently Asked Questions

What is health tech investment?

Health tech investment refers to investing in companies that are developing innovative technologies and solutions to improve healthcare and wellness.

How can one identify promising health tech startups?

Promising health tech startups can be identified by looking at their leadership team, the problem they are addressing, their technology, and market potential.

Why is it important to diversify your health tech investment portfolio?

Diversifying your health tech investment portfolio can help spread risk and maximize potential returns by investing in different companies and technologies within the health tech sector.

What are some ways to maximize passive income through health tech investments?

Passive income through health tech investments can be maximized by reinvesting dividends, choosing high-yield stocks, and leveraging compounding interest.

What are the potential risks of health tech investments?

Potential risks of health tech investments include technological and regulatory challenges, market competition, and the uncertainty of clinical trials and outcomes.

How can one evaluate the potential risks of health tech investments?

The potential risks of health tech investments can be evaluated by assessing the company’s regulatory compliance, intellectual property protection, market competition, and the performance of their products or services.

What are the key factors to consider before making health tech investments?

Key factors to consider before making health tech investments include the company’s leadership, market opportunity, competitive advantage, and the potential impact of their technology on healthcare outcomes.