As the world of decentralized finance (DeFi) continues to grow and evolve, the importance of effective governance within this space becomes increasingly apparent. Understanding how governance works in the realm of DeFi is essential for anyone involved in this revolutionary financial system. In this blog post, we will delve into the intricacies of DeFi governance, discussing its significance, key challenges, best practices, and the role of community engagement. By exploring these topics, we aim to provide readers with a comprehensive understanding of how to effectively manage decentralized finance in a way that fosters innovation, inclusion, and sustainability. Whether you are a DeFi enthusiast, investor, or simply curious about this emerging sector, this post will shed light on the critical role governance plays in shaping the future of decentralized finance.

Understanding Decentralized Finance (DeFi) Governance

Decentralized Finance (DeFi) has been gaining significant attention in recent years as it offers a new way to manage financial transactions without the need for traditional intermediaries. However, the success of DeFi platforms heavily relies on effective governance mechanisms to ensure the sustainability and security of the ecosystem.

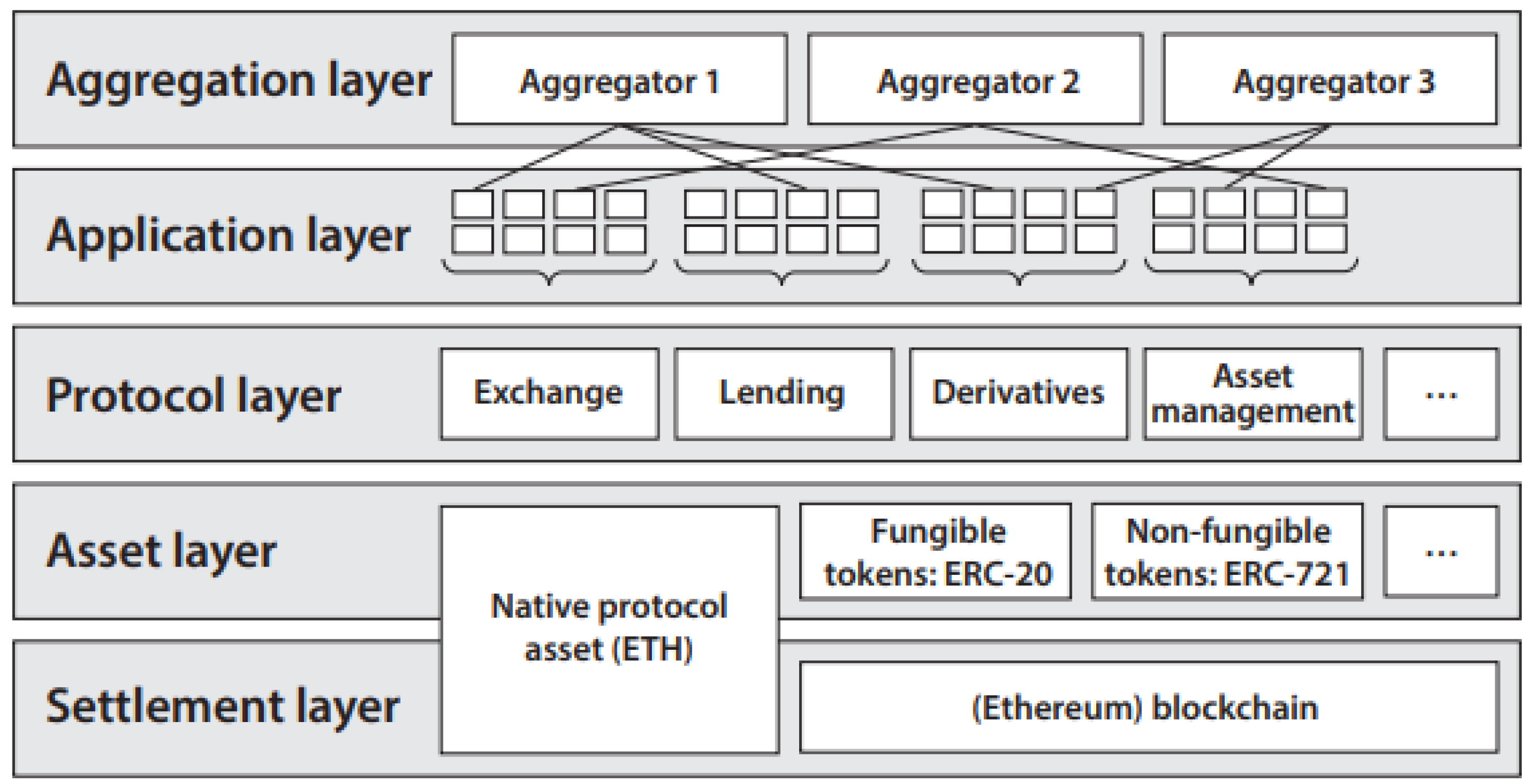

DeFi governance refers to the process of making decisions that affect the entire ecosystem, including protocol upgrades, asset listings, and risk management. Unlike traditional finance where centralized authorities make all the decisions, DeFi governance is conducted through decentralized mechanisms such as voting and community consensus.

One of the key aspects of understanding DeFi governance is the importance of transparency and inclusivity. In a decentralized ecosystem, all stakeholders should have the opportunity to participate in the decision-making process. This ensures that the interests of the entire community are represented, leading to more resilient and fair governance.

Additionally, understanding the mechanisms of DeFi governance is crucial for addressing potential challenges such as security vulnerabilities, regulatory compliance, and conflicts of interest. By comprehensively understanding the governance structure, DeFi platforms can implement best practices to mitigate risks and enhance the overall security and stability of the ecosystem.

Importance of Effective Governance in DeFi

In the ever-evolving world of decentralized finance (DeFi), the importance of effective governance cannot be understated. With the explosive growth of DeFi platforms and the vast sums of money at stake, the need for robust governance mechanisms has never been more critical.

Effective governance in DeFi is essential for ensuring the stability, security, and sustainability of decentralized financial systems. Without proper governance, DeFi platforms are vulnerable to a range of risks, including security breaches, protocol failures, and potential collapse.

Furthermore, the decentralized nature of DeFi means that governance decisions are often made by a community of users, making it crucial for effective governance structures to be in place to ensure that the platform operates fairly and transparently.

Ultimately, the importance of effective governance in DeFi cannot be overstated. It is the foundation upon which the entire ecosystem is built, and without it, the future of decentralized finance could be at risk.

Key Challenges of Managing Decentralized Finance

One of the key challenges of managing decentralized finance (DeFi) is the issue of security. With DeFi platforms operating without the oversight of a central authority, the risk of security breaches, hacks, and vulnerabilities is significantly heightened. This poses a significant challenge for those managing DeFi projects, as ensuring the safety of funds and user data is of utmost importance.

Another major challenge in managing DeFi is the issue of scalability. As the popularity of DeFi continues to grow, the demand for transactions and liquidity on these platforms also increases. This can lead to congestion and slower transaction times, posing a significant challenge for DeFi managers in effectively managing these platforms and maintaining optimal performance.

Furthermore, a key challenge in managing DeFi is the issue of regulatory compliance. DeFi platforms often operate across multiple jurisdictions, making it difficult to navigate the complex web of regulatory requirements and laws. This poses a challenge for DeFi managers in ensuring that their platforms are compliant with all relevant regulations, which can be a daunting task.

Lastly, one of the key challenges in managing DeFi is the issue of governance. With decentralized decision-making processes and the involvement of a wide range of stakeholders, reaching a consensus on governance issues can be challenging. This can lead to delays in decision-making and difficulties in implementing changes, posing a significant challenge for those managing DeFi projects.

Best Practices for Governance in DeFi

When it comes to decentralized finance (DeFi), one of the most crucial aspects is governance. The decentralized nature of DeFi means that it operates without a central authority, so effective governance is essential to ensure that the platform operates smoothly and transparently. There are several best practices that can be followed to ensure effective governance in DeFi.

One of the most important best practices for governance in DeFi is transparency. All decisions and actions should be transparent and publicly accessible to ensure accountability and trust within the community. This can be achieved through open communication channels and clear documentation of governance processes.

Another best practice for governance in DeFi is community involvement. The community should have an active role in decision-making processes, as they are the ones directly impacted by governance decisions. This can be achieved through voting mechanisms and community forums where members can express their opinions and feedback.

Furthermore, clear and well-defined governance processes are essential for effective governance in DeFi. This includes establishing decision-making processes, defining the roles and responsibilities of governance participants, and outlining the procedures for proposing and implementing changes.

The Role of Community Engagement in DeFi Governance

Decentralized Finance (DeFi) governance is a crucial aspect of the rapidly growing cryptocurrency industry. In order to ensure the smooth operation and development of DeFi platforms, effective governance is necessary. One of the key elements of successful governance in DeFi is community engagement. Community engagement involves actively involving the users and stakeholders of a DeFi platform in the decision-making process, ensuring that the governance structure is truly decentralized and democratic.

Community engagement in DeFi governance plays a vital role in ensuring that the interests and concerns of all stakeholders are taken into consideration. By actively involving the community in decision-making processes, DeFi platforms can gain valuable insights and feedback from their users, leading to more informed and effective governance decisions.

Furthermore, community engagement helps to build a sense of ownership and responsibility among users, fostering a stronger and more loyal community. This can lead to increased participation and collaboration, ultimately contributing to the growth and success of the DeFi platform.

Overall, the role of community engagement in DeFi governance cannot be overstated. It is a fundamental element of ensuring that governance in DeFi remains decentralized, transparent, and aligned with the interests of the community. By actively involving the community in decision-making processes, DeFi platforms can establish a more robust and inclusive governance framework, ultimately leading to a more resilient and prosperous DeFi ecosystem.

Frequently Asked Questions

What is DeFi governance?

DeFi governance refers to the decentralized decision-making process and management of decentralized finance platforms and protocols by the community and stakeholders, often through voting and proposals.

Why is effective governance important in DeFi?

Effective governance in DeFi is important to ensure transparency, security, and the smooth operation of protocols. It also helps to foster trust and confidence among users and stakeholders.

What are the key challenges of managing decentralized finance?

Key challenges of managing decentralized finance include scalability, interoperability, regulatory compliance, security vulnerabilities, and the need for consensus among community members.

What are the best practices for governance in DeFi?

Best practices for governance in DeFi include clear and transparent decision-making processes, community engagement, strong security measures, regular audits, and mechanisms for resolving disputes.

What is the role of community engagement in DeFi governance?

Community engagement is crucial in DeFi governance as it enables active participation, feedback, and consensus-building among stakeholders, ultimately leading to better decision-making and protocol improvements.

How can effective governance contribute to the advancement of DeFi?

Effective governance can contribute to the advancement of DeFi by fostering innovation, improving user experience, ensuring security, and ultimately driving the growth and adoption of decentralized finance.