Are you curious about investing in Investing in Cryptocurrency but unsure of the potential risks and rewards? Cryptocurrency has become a popular investment option in recent years, but it comes with its own set of challenges and opportunities. In this blog post, we will delve into the world of cryptocurrency investments and explore the various aspects of this emerging market. From understanding the basics of cryptocurrency investments to assessing the risks and potential rewards, we will provide insights to help you make informed decisions. Additionally, we will discuss strategies for mitigating risks and compare long-term versus short-term investment approaches. Whether you are a seasoned investor or just starting out, this post will provide valuable information to help you navigate the complex and ever-changing landscape of cryptocurrency investments. Join us as we explore the risks and rewards of investing in cryptocurrency.

Understanding Investing in Cryptocurrency Investments

Cryptocurrency investments have become increasingly popular in recent years as digital currencies such as Bitcoin and Ethereum have surged in value. But what exactly are cryptocurrency investments, and how do they work? Essentially, cryptocurrency investments involve buying and holding digital currencies in the hopes that their value will increase over time. Unlike traditional stocks or bonds, cryptocurrencies are decentralized and operate on a blockchain, a digital ledger that records all transactions.

Investing in cryptocurrencies can be a complex and volatile endeavor, as the market is highly speculative and prices can fluctuate dramatically in short periods of time. It’s important for potential investors to thoroughly research and understand the cryptocurrency market before diving in, as the risks and rewards can be significant.

One key aspect of understanding cryptocurrency investments is grasping the technology behind digital currencies. Blockchain, the underlying technology of most cryptocurrencies, is a secure and transparent way of recording transactions. This technology has the potential to revolutionize finance and is one of the main drivers behind the interest in cryptocurrency investments.

While cryptocurrency investments can be lucrative, they also come with their fair share of risks. Understanding the market, the technology, and the associated risks is crucial for anyone considering getting involved in cryptocurrency investments.

Assessing the Risks of Cryptocurrency Investments

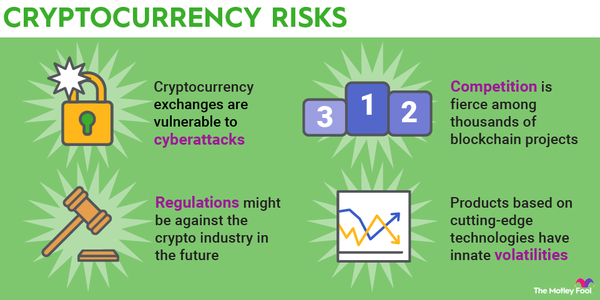

When it comes to cryptocurrency investments, it is crucial to have a clear understanding of the potential risks involved. One of the main risks is the high volatility of the cryptocurrency market. Prices can fluctuate dramatically in a short period of time, leading to potential losses for investors. Additionally, the lack of regulation in the cryptocurrency market poses a significant risk. This means that investors may not have the same level of protection as they do in traditional financial markets.

Another risk to consider is the security of cryptocurrency investments. Cyberattacks and hacking incidents are not uncommon in the cryptocurrency space, and investors need to be aware of the potential security threats. Furthermore, the technology behind cryptocurrencies is constantly evolving, and there is a risk that a particular cryptocurrency could become obsolete in the future, leading to a loss of investment.

It is also important for investors to consider the legal and regulatory risks associated with cryptocurrency investments. Regulations surrounding cryptocurrencies vary from country to country, and changes in legislation can have a significant impact on the value of a particular cryptocurrency. Investors need to stay informed about the legal landscape to assess the potential risks effectively.

In conclusion, while cryptocurrency investments offer the potential for high returns, it is essential for investors to carefully assess the risks involved. Understanding the market volatility, security threats, technological changes, and regulatory environment is crucial to making informed investment decisions in the cryptocurrency space.

Potential Rewards of Investing in Cryptocurrencies

Investing in cryptocurrencies can potentially offer significant rewards for those willing to take the risk. One of the main draws of crypto investments is the potential for high returns. Many people have seen their initial investment in Bitcoin or other cryptocurrencies grow exponentially over a relatively short period of time.

Another potential reward of investing in cryptocurrencies is the opportunity to diversify one’s investment portfolio. Traditional investments like stocks and bonds are subject to the ebbs and flows of the stock market, whereas the value of crypto assets can be influenced by different factors, providing a hedge against traditional market risks.

Furthermore, the decentralized nature of cryptocurrencies means that they are not subject to the influence of governments or financial institutions. This can provide a sense of security for investors who are wary of political or economic instability in traditional financial systems.

Finally, the potential for technological innovation and disruption in various industries through blockchain technology and cryptocurrencies present an opportunity for early investors to benefit from the growth and adoption of these new technologies.

Mitigating Risks in Cryptocurrency Investments

When it comes to investing in cryptocurrencies, there are some inherent risks that investors must be aware of and prepared to mitigate. One of the biggest risks is the volatile nature of the market. Cryptocurrency prices can fluctuate dramatically in a short period of time, leading to potential losses for investors. In order to mitigate this risk, it’s important to diversify your investment portfolio. Instead of putting all your money into one cryptocurrency, consider spreading it out across several different ones.

Another way to mitigate risk in cryptocurrency investments is to do thorough research before making any investment decisions. This includes understanding the technology behind the cryptocurrency, the team behind the project, and the potential use cases for the digital currency. By doing your due diligence, you can make more informed investment decisions and reduce the likelihood of falling victim to fraud or scams.

Additionally, it’s important to have a clear investment strategy and stick to it. This means setting realistic goals for your investments, establishing stop-loss orders to limit potential losses, and not making impulsive decisions based on market hype or fear. By having a disciplined approach to investing in cryptocurrencies, you can mitigate the risk of emotional decision-making.

Finally, consider the use of hedging strategies to mitigate risk in your cryptocurrency investments. This can include using options or futures contracts to protect against potential price declines. While hedging can be complex and may not be suitable for all investors, it’s worth exploring as a way to safeguard your investment portfolio.

Long-Term vs. Short-Term Cryptocurrency Investment Strategies

When considering long-term vs. short-term cryptocurrency investment strategies, it’s important to understand the differences between the two approaches. Long-term investment strategies involve holding onto cryptocurrency assets for an extended period of time, often years, with the expectation that their value will increase significantly over time. On the other hand, short-term investment strategies involve buying and selling cryptocurrency assets within a much shorter time frame, often days, weeks, or months, in order to take advantage of short-term price fluctuations.

One of the main advantages of a long-term cryptocurrency investment strategy is the potential for significant returns over time. By holding onto assets for a long period, investors can benefit from compounding returns as the value of the assets increases. Additionally, long-term investors may also benefit from the potential for lower tax rates on long-term capital gains.

Conversely, short-term cryptocurrency investment strategies may be more appealing to those looking to capitalize on short-term price movements. While short-term trading carries a higher degree of risk due to the potential for significant price fluctuations, it also offers the potential for quicker, albeit smaller, returns. Short-term strategies may also be more suitable for active traders who are comfortable with the high levels of volatility often associated with the cryptocurrency market.

Ultimately, the decision between long-term vs. short-term cryptocurrency investment strategies will depend on an investor’s individual goals, risk tolerance, and investment timeframe. Some investors may choose to utilize a combination of both strategies in their overall investment approach, in order to diversify their holdings and maximize potential returns while managing risk.

Frequently Asked Questions

What is cryptocurrency investment?

Cryptocurrency investment involves buying, holding, or trading digital currencies with the expectation of gaining a return on investment.

What are the risks of investing in cryptocurrency?

Some risks of investing in cryptocurrency include price volatility, security vulnerabilities, regulatory uncertainty, and potential for market manipulation.

What are the potential rewards of investing in cryptocurrencies?

Potential rewards of investing in cryptocurrencies include high returns on investment, diversification of investment portfolio, and opportunities for early adoption of innovative technology.

How can one mitigate risks in cryptocurrency investments?

Some ways to mitigate risks in cryptocurrency investments include thorough research, portfolio diversification, use of secure storage solutions, and staying informed about market trends and regulatory changes.

What are the differences between long-term and short-term cryptocurrency investment strategies?

Long-term cryptocurrency investment strategies involve holding digital assets for an extended period, while short-term strategies focus on profiting from price fluctuations through frequent buying and selling.

Why is understanding cryptocurrency investments important?

Understanding cryptocurrency investments is important to make informed decisions, manage risks effectively, and maximize the potential rewards of investing in digital currencies.

How to assess the risks of cryptocurrency investments?

Assessing the risks of cryptocurrency investments involves evaluating factors such as market volatility, cybersecurity risks, regulatory environment, and the credibility of the cryptocurrency project.