In recent years, the rise of Decentralized Finance (DeFi) has posed a significant challenge to traditional banking systems. This innovative technology leverages blockchain and smart contracts to provide financial services outside of the traditional banking infrastructure. As a result, DeFi is disrupting the traditional banking landscape in unprecedented ways. In this blog post, we will delve into the impact of DeFi on traditional banking, exploring how it is driving increased financial inclusion and the challenges and opportunities it presents for traditional banks. We will also examine the potential for collaboration between DeFi and traditional banks, as they navigate this evolving financial landscape. Join us as we explore the transformative influence of DeFi and the implications it holds for the future of finance.

Introduction to DeFi and Traditional Banking

Decentralized Finance (DeFi) is a revolutionary concept that is transforming the traditional banking landscape. It involves the use of blockchain technology to create a decentralized financial system that is accessible to everyone, without the need for intermediaries such as banks. On the other hand, traditional banking has been the backbone of the global financial system for centuries, providing essential services such as lending, payments, and investment management.

As we delve into the world of DeFi and traditional banking, it is essential to understand the fundamental differences between the two. DeFi operates on a decentralized, transparent, and permissionless network, whereas traditional banking relies on centralized institutions governed by regulatory authorities. Furthermore, DeFi offers a wide range of financial services such as lending, borrowing, trading, and asset management, all of which are carried out through smart contracts on the blockchain.

While DeFi presents a disruptive force in the financial industry, traditional banks are increasingly exploring ways to collaborate with DeFi platforms to enhance their services and stay competitive in the evolving market. This collaboration has the potential to bridge the gap between traditional finance and DeFi, offering consumers a broader range of financial products and services.

Overall, the introduction of DeFi has sparked a digital revolution in the financial sector, challenging the traditional banking model and prompting institutions to adapt to the changing landscape. As we continue to witness the evolution of DeFi and traditional banking, it is crucial to explore the challenges and opportunities that arise from this intersection of two distinct financial ecosystems.

Disrupting the Traditional Banking Landscape

The rise of DeFi, or decentralized finance, is creating significant disruptions in the traditional banking landscape. DeFi is a system that aims to recreate traditional financial systems such as banks, exchanges, and lending through the use of blockchain technology and smart contracts. This innovative approach to finance is challenging the traditional banking system by providing more accessible, efficient, and transparent financial services to a broader range of people.

One of the key ways in which DeFi is disrupting the traditional banking landscape is through increased financial inclusion. Traditional banks have historically excluded many individuals and communities from accessing basic financial services due to factors such as income, location, or credit history. DeFi, on the other hand, offers borderless access to financial services, allowing anyone with an internet connection to participate in the global economy.

Another significant impact of DeFi on traditional banks is the potential for collaboration between the two systems. Rather than viewing DeFi as a threat to their existence, traditional banks have the opportunity to embrace the innovation and technological advancement offered by DeFi. By collaborating with DeFi platforms, banks can leverage the benefits of blockchain technology and smart contracts to streamline their operations and provide more inclusive and efficient financial services to their customers.

While DeFi presents exciting opportunities for disrupting the traditional banking landscape, it also poses challenges for traditional banks. The shift towards decentralized finance requires traditional banks to adapt to a rapidly changing financial ecosystem and compete with new players entering the market. This shift also raises questions about regulatory frameworks and consumer protection, as the decentralized nature of DeFi presents unique challenges for oversight and governance.

Increased Financial Inclusion Through DeFi

The rise of DeFi (Decentralized Finance) has brought about a significant shift in the way people access and manage their finances. One of the key benefits of DeFi is the increased financial inclusion it offers to individuals who may have been excluded from traditional banking systems. Through the use of blockchain technology and smart contracts, DeFi platforms are able to provide financial services to a wider range of people, including those in developing countries or with limited access to traditional banking.

By removing the need for a central authority or intermediary, DeFi allows individuals to access services such as lending, borrowing, and trading without the need for a traditional bank account. This opens up opportunities for individuals who may not have had access to these services before, and enables them to participate in the global economy on their own terms.

Furthermore, DeFi platforms often have lower barriers to entry, making it easier for individuals to access financial services without the need for extensive documentation or credit history. This can be particularly beneficial for those who have been underserved or marginalized by traditional banking systems, and can help to bridge the gap between the financially included and the financially excluded.

As a result, DeFi has the potential to significantly increase financial inclusion on a global scale, empowering individuals to take control of their finances and participate in the broader financial ecosystem in a way that was previously not possible.

Challenges and Opportunities for Traditional Banks

Traditional banks have long been the cornerstone of the financial industry, providing essential services such as savings accounts, loans, and investment opportunities. However, in recent years, traditional banks have faced a number of challenges that have forced them to adapt and evolve in order to remain competitive in a rapidly changing landscape.

One of the primary challenges for traditional banks is the rise of DeFi, or decentralized finance. DeFi platforms, such as cryptocurrency exchanges and lending protocols, offer an alternative to traditional banking services by leveraging blockchain technology to provide open, permissionless access to financial services. This presents a significant threat to traditional banks, as more and more consumers are turning to DeFi for its lower fees, faster transactions, and greater transparency.

Despite these challenges, traditional banks also have a number of opportunities to innovate and grow in the face of increasing competition from DeFi. For example, many banks are exploring the use of blockchain technology to streamline their operations and reduce costs. Additionally, banks can leverage their existing customer base and brand recognition to offer new, innovative financial products and services that appeal to a changing consumer base.

In conclusion, while traditional banks face significant challenges from the rise of DeFi, there are also many opportunities for them to adapt and thrive in a rapidly changing financial landscape. By embracing innovation and leveraging their strengths, traditional banks can continue to play a vital role in the financial industry for years to come.

Collaboration between DeFi and Traditional Banks

Decentralized Finance, or DeFi, has been making waves in the financial industry as it offers a new way for individuals to access financial services without the need for traditional banks. However, rather than being seen as a threat, DeFi could actually be a valuable partner for traditional banks in the future.

One of the key opportunities for collaboration between DeFi and traditional banks is in the area of financial inclusion. Traditional banks have faced challenges in providing accessible financial services to underserved communities, but with the rise of DeFi, there is potential for collaboration to increase financial inclusion. By leveraging the decentralized nature of DeFi, traditional banks could expand their reach and provide services to those who have previously been excluded from the financial system.

Another area for collaboration is in innovation. DeFi has been at the forefront of driving innovation in the financial industry, with new technologies such as blockchain and smart contracts opening up new possibilities. Traditional banks can benefit from partnering with DeFi platforms to leverage these innovations and offer their customers new and improved services.

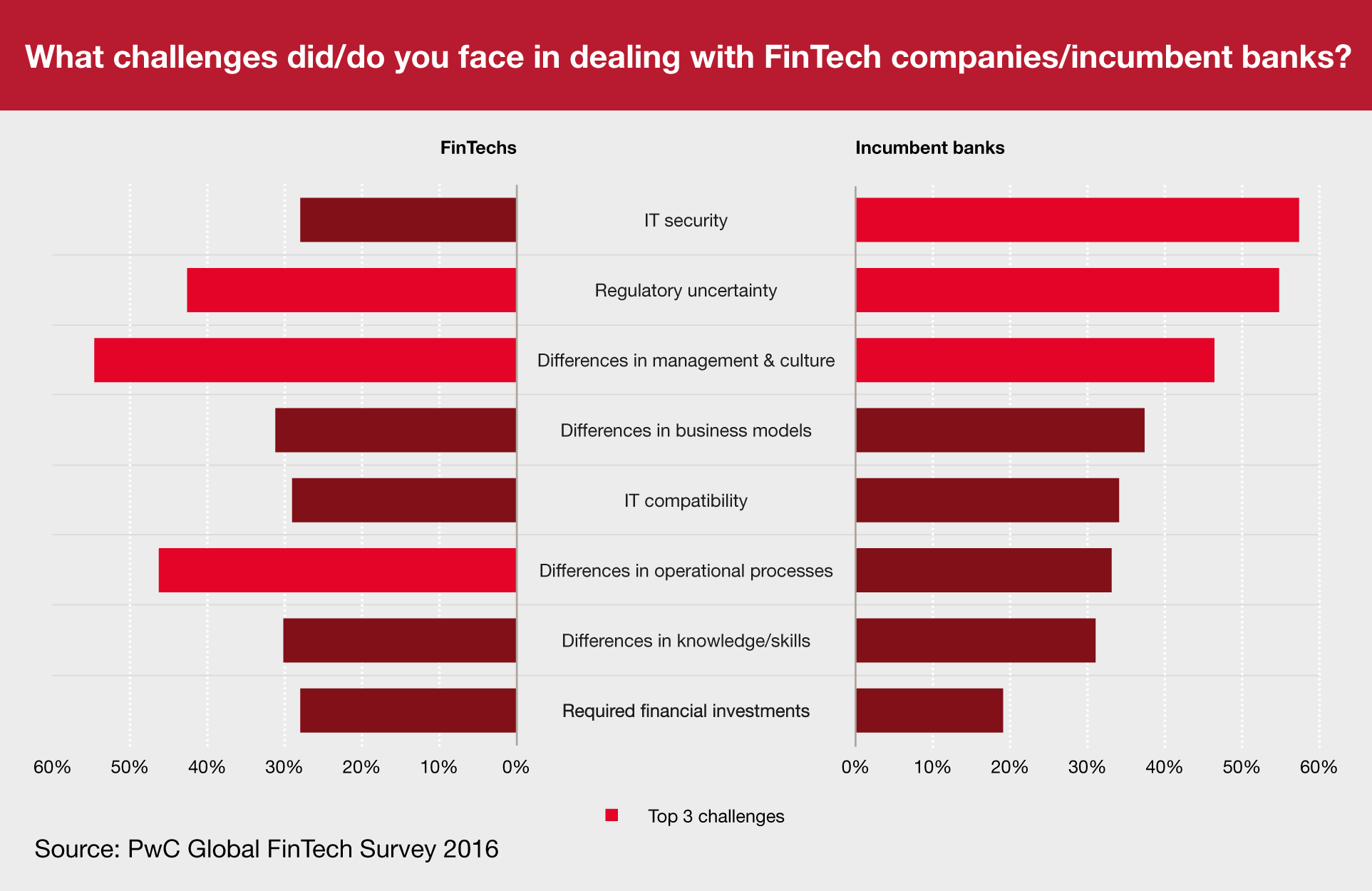

While there are opportunities for collaboration, there are also challenges that need to be addressed. One of the main challenges is the need to ensure regulatory compliance when collaborating with DeFi platforms. As the regulatory landscape for DeFi continues to evolve, traditional banks will need to navigate these complexities to ensure that any collaboration is compliant with regulations.

Frequently Asked Questions

What is DeFi and traditional banking?

DeFi, short for decentralized finance, refers to the use of blockchain technology to recreate traditional financial systems including banking, lending, and trading without the need for traditional intermediaries. Traditional banking refers to the established system of financial institutions that provide services such as deposits, loans, and investments.

How is DeFi disrupting the traditional banking landscape?

DeFi is disrupting the traditional banking landscape by enabling financial services to be accessed and utilized by anyone with an internet connection, without the need for a traditional bank as an intermediary. This poses a threat to traditional banks as they may lose their customer base to DeFi platforms.

How does DeFi increase financial inclusion?

DeFi increases financial inclusion by providing access to financial services to individuals who are unbanked or underbanked, often in developing countries. Through DeFi, people can access loans, savings, and investments without the need for a traditional bank account.

What are the challenges and opportunities for traditional banks in the face of DeFi?

The challenges for traditional banks include the potential loss of market share and customers to DeFi platforms, as well as the need to adapt to changing technology and consumer preferences. However, there are opportunities for traditional banks to collaborate with DeFi platforms and leverage blockchain technology to improve their own services.

How can DeFi and traditional banks collaborate?

DeFi and traditional banks can collaborate by implementing blockchain technology in banking operations, partnering with DeFi platforms to offer new financial products and services, and exploring ways to bridge the gap between the two systems for the benefit of consumers.

What are the potential benefits of collaboration between DeFi and traditional banks?

The potential benefits of collaboration include increased efficiency, lower costs, improved access to financial services, and the ability to leverage the strengths of both systems to provide a more comprehensive range of services to consumers.

What does the future hold for the relationship between DeFi and traditional banking?

The future relationship between DeFi and traditional banking is likely to involve a combination of competition and collaboration, as both systems seek to adapt to changing technological and consumer trends. Traditional banks may need to embrace DeFi and blockchain technology to remain competitive, while also finding ways to differentiate themselves in a rapidly evolving financial ecosystem.