Cryptocurrency investment has become increasingly popular in recent years, but with it comes a level of risk that can be daunting for many. Understanding the psychology behind risk-taking in crypto investments is crucial for making informed decisions in this ever-changing market. In this blog post, we will explore the various factors that influence our risk-taking behavior when it comes to crypto investments. From the role of emotions and cognitive biases to the impact of past experiences and social influence, we will delve into the inner workings of the human mind when it comes to investment decisions. Additionally, we will provide strategies for managing risk in crypto investments, empowering you to make more confident and calculated choices in this volatile market. Whether you’re a seasoned investor or just dipping your toes into the crypto world, this blog post will offer valuable insights into the psychology of risk-taking in cryptocurrency investments.

Understanding the Role of Emotions in Risk-Taking

Emotions play a crucial role in the decisions we make, especially when it comes to taking risks. Fear, greed, excitement, and anxiety are some of the emotions that can heavily influence our risk-taking behavior. When it comes to crypto investments, these emotions can be particularly intense due to the volatile nature of the market.

For example, the fear of missing out (FOMO) can lead investors to make impulsive decisions, such as buying into a coin at its peak. On the other hand, the fear of losing money may cause investors to sell off their assets prematurely, missing out on potential gains. Understanding how these emotions impact our risk-taking behavior is essential for making informed and rational investment decisions.

Moreover, emotions can also cloud our judgment and lead to irrational decision-making. When investors let their emotions dictate their actions, they are more likely to take on unnecessary risks or overlook important factors that could impact their investments. Recognizing the role that emotions play in risk-taking is the first step towards developing a disciplined and strategic approach to investment.

By acknowledging the influence of emotions in risk-taking, investors can take proactive measures to manage and mitigate their impact. This could include setting clear investment goals, establishing risk management strategies, and seeking the guidance of financial professionals to provide valuable insights and alternative perspectives.

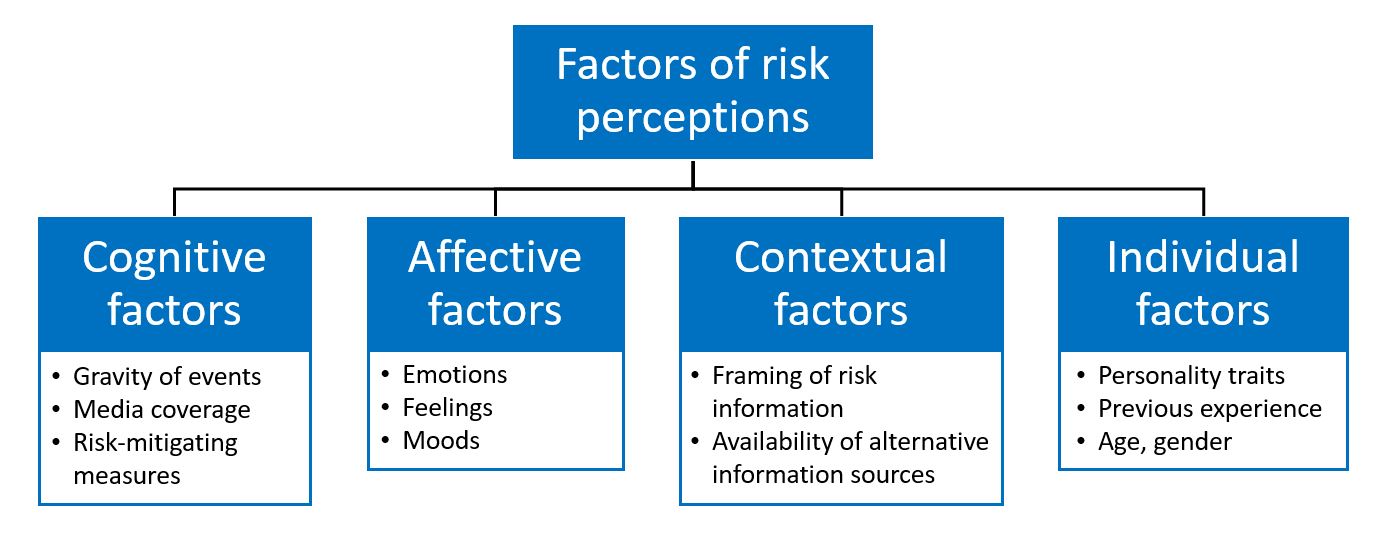

How Cognitive Biases Influence Crypto Investment Decisions

Cognitive biases play a significant role in shaping our decision-making processes, especially when it comes to making crypto investment decisions. These biases are essentially mental shortcuts that our brains use to make decisions based on limited information and personal preferences rather than rational analysis. One common cognitive bias that impacts crypto investment decisions is the confirmation bias, where individuals seek out information that confirms their existing beliefs about a particular investment, leading them to overlook conflicting data that may indicate potential risks.

Another influential cognitive bias in crypto investment decisions is the herd mentality, also known as the bandwagon effect. This bias occurs when individuals make investment decisions based on the actions of others rather than conducting their own independent research and analysis. This can lead to a situation where the market becomes over-inflated due to a large number of investors following the same trend, potentially leading to a sudden and significant market correction.

Furthermore, the availability heuristic is another cognitive bias that can impact crypto investment decisions. This bias occurs when individuals rely on readily available information, such as recent market trends or news stories, to make investment decisions rather than conducting a thorough and comprehensive analysis of all relevant factors. This can lead to impulsive investment decisions based on short-term market fluctuations rather than long-term investment strategies.

Lastly, overconfidence bias is another cognitive bias that can influence crypto investment decisions. This bias occurs when individuals overestimate their ability to predict market movements and believe that their investment decisions are more accurate than they actually are. This can lead to excessive risk-taking and a failure to adequately assess and mitigate potential investment risks.

The Influence of Past Experiences on Risk-Taking Behavior

When it comes to risk-taking behavior, our past experiences play a significant role in shaping our decisions. Our past successes and failures, as well as the lessons we’ve learned along the way, can greatly influence how we approach risks in the future. For example, someone who has experienced a major financial loss in the past may be more cautious when it comes to making risky investments, while someone who has had success in the past may be more inclined to take on higher levels of risk.

Moreover, our past experiences can also influence how we perceive and assess different types of risks. If we’ve had positive experiences with certain types of risks in the past, we may be more likely to view them in a favorable light and be more willing to take them on in the future. On the other hand, negative past experiences may make us more reluctant to engage in similar risky behavior.

It’s important to recognize the impact that our past experiences can have on our risk-taking behavior, especially when it comes to crypto investments. Understanding how our past experiences shape our attitudes towards risk can help us make more informed decisions and manage our risks more effectively in the future.

Ultimately, being aware of the influence of past experiences on risk-taking behavior can empower us to approach risk with a greater sense of understanding and control, allowing us to make decisions that are more aligned with our long-term financial goals.

The Impact of Social Influence on Crypto Investment Risk

When it comes to crypto investments, the impact of social influence cannot be overlooked. The decisions of investors are often influenced by the actions and opinions of others within their social circle, whether it’s friends, family, or online communities. This social influence can lead to both positive and negative outcomes, as individuals may feel pressured to follow the crowd without fully understanding the potential risks involved.

One way in which social influence can impact crypto investment risk is through the fear of missing out, or FOMO. When investors see others profiting from a particular cryptocurrency or investment strategy, they may feel compelled to join in, regardless of the potential risks. This can lead to impulsive decision-making and a lack of proper research and due diligence, ultimately increasing the likelihood of losses.

Additionally, social influence can create a herd mentality among investors, where individuals are more likely to follow the actions of the majority rather than making independent decisions based on their own analysis. This can lead to increased market volatility and irrational behavior, further exacerbating investment risk within the crypto space.

It’s important for crypto investors to be aware of the impact of social influence on their decision-making process. By staying informed, conducting thorough research, and seeking advice from trusted sources, investors can mitigate the potential negative effects of social influence and make more informed decisions that align with their investment goals and risk tolerance.

Strategies for Managing Risk in Crypto Investments

When it comes to managing risk in crypto investments, it is important to have a clear understanding of the market and the various factors that can impact the value of your investments. One of the key strategies for managing risk in crypto investments is diversification. By spreading your investments across a range of different cryptocurrencies, you can minimize the impact of any one asset performing poorly.

Another important strategy for managing risk in crypto investments is to set clear investment goals and to stick to them. This includes setting limits for the amount of money you are willing to invest, as well as a clear exit strategy for when you will sell your assets, regardless of their performance.

Additionally, it is crucial to stay informed about the latest market trends and news that could potentially impact the value of your investments. This can involve staying up to date with market analysis, technical trends, and regulatory changes that could impact the crypto market.

Finally, it is important to not let emotions dictate your investment decisions. Fear and greed can lead to poor decision-making and can result in unnecessary risks. By staying rational and sticking to your investment strategy, you can better manage the risks associated with crypto investments.

Frequently Asked Questions

What role do emotions play in risk-taking in crypto investments?

Emotions can heavily influence risk-taking in crypto investments. Greed, fear, and excitement can lead to impulsive decision-making and higher risk-taking behavior.

How do cognitive biases impact crypto investment decisions?

Cognitive biases, such as overconfidence and confirmation bias, can lead to irrational decision-making in crypto investments. It’s important to be aware of these biases and work to mitigate their influence.

Can past experiences impact risk-taking behavior in crypto investments?

Yes, past experiences, particularly past investment successes or failures, can significantly impact an individual’s willingness to take risks in crypto investments. It’s important to reflect on and learn from past experiences to make more informed decisions.

How does social influence affect risk-taking in crypto investments?

Social influence, such as the actions and opinions of others in the crypto community, can impact an individual’s risk-taking behavior. It’s important to be mindful of the influence of others and make decisions based on personal analysis and research.

What are some strategies for managing risk in crypto investments?

Diversification, thorough research, setting clear investment goals, and practicing discipline are all effective strategies for managing risk in crypto investments. It’s important to have a well-informed and balanced approach to investment decisions.

How can understanding the psychology of risk-taking improve crypto investment outcomes?

Understanding the psychology of risk-taking can help investors make more rational and informed decisions, ultimately leading to better investment outcomes. By recognizing and managing the influence of emotions, biases, and past experiences, investors can improve their overall investment strategy.

What is the impact of risk-taking behavior on long-term crypto investment success?

Risk-taking behavior can impact long-term crypto investment success by affecting overall portfolio performance and potential for substantial gains or losses. By understanding and managing risk, investors can work towards more sustainable long-term success.