Crypto investments have become increasingly popular in recent years, with more and more individuals looking to diversify their portfolios and capitalize on the potential gains offered by digital assets. One key component of the crypto market that has gained significant attention is stablecoins. In this post, we will delve into the role of stablecoins in crypto investments, covering everything from their purpose and advantages to the various types available in the market. We will also discuss the factors to consider when choosing a stablecoin for investment and evaluate the impact of stablecoins on the overall crypto market. Whether you’re a seasoned crypto investor or just starting out in the digital asset space, understanding the role of stablecoins is essential for making informed investment decisions. Let’s explore the world of stablecoins and their significance in the realm of crypto investments.

Understanding stablecoins and their purpose

Stablecoins are a type of cryptocurrency that is designed to have a stable value, unlike traditional cryptocurrencies such as Bitcoin and Ethereum, which are known for their price volatility. The primary purpose of stablecoins is to provide a reliable and consistent store of value, making them a suitable option for everyday transactions and as a hedge against market volatility.

One of the key advantages of stablecoins is their stability, which is achieved by pegging their value to an underlying asset such as fiat currency, commodity, or even another cryptocurrency. This pegging mechanism ensures that their value remains relatively constant, making them ideal for use in everyday transactions and as a means of preserving wealth.

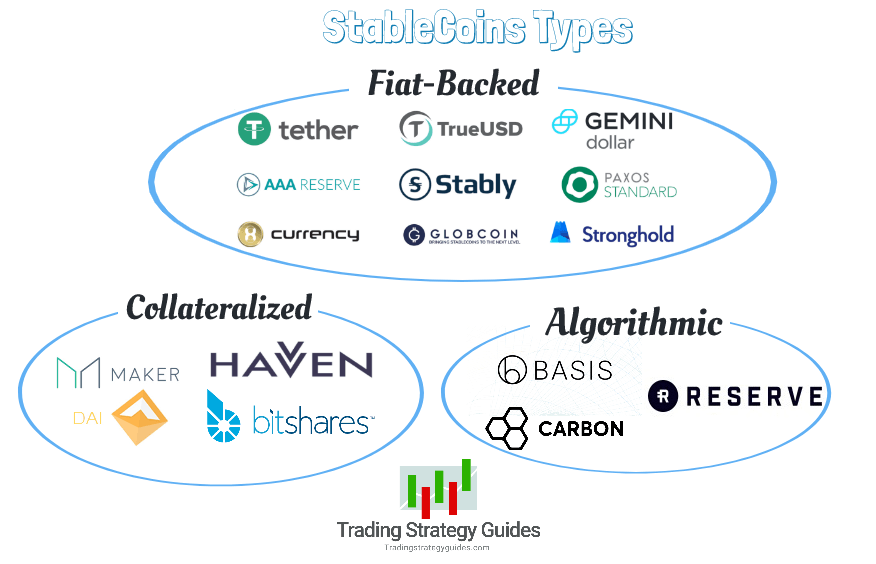

There are several different types of stablecoins available in the market, each with its own unique features and characteristics. Some stablecoins are backed by fiat currency, while others are collateralized by other assets or use algorithmic mechanisms to maintain their stability. Understanding the different types of stablecoins and their underlying mechanisms is crucial for anyone looking to get involved in the crypto market.

When considering investing in stablecoins, there are several factors to take into account. These include the stability of the underlying assets, the transparency and accountability of the stablecoin issuer, and the level of decentralization of the stablecoin’s governance. It is important to thoroughly research and understand these factors before making any investment decisions.

Advantages of using stablecoins for crypto investments

Stablecoins have gained popularity in the crypto space due to their unique advantages for investors. One of the main advantages of using stablecoins for crypto investments is the reduced volatility. Unlike traditional cryptocurrencies like Bitcoin and Ethereum, stablecoins are designed to maintain a stable value, usually pegged to a fiat currency like the US dollar. This stability makes them a more predictable and less risky investment option for those looking to enter the crypto market.

Another advantage of using stablecoins for crypto investments is the ease of use in trading and transactions. Many stablecoins are built on blockchain technology, which allows for fast and efficient transfers of value across borders. This means that investors can easily trade stablecoins on crypto exchanges or use them for purchases without having to worry about the delays and fees associated with traditional banking systems.

Furthermore, stablecoins offer a hedge against market downturns. In times of market volatility or uncertainty, investors often look for safe havens to protect their capital. Stablecoins provide a way for investors to move their funds out of riskier assets while still maintaining exposure to the crypto market. This can help to mitigate potential losses and preserve wealth during challenging market conditions.

Lastly, using stablecoins for crypto investments can provide greater liquidity for investors. Since stablecoins are pegged to stable assets, they can be easily converted into fiat currency or used as collateral for loans. This can be particularly useful for investors who want to access their funds quickly or leverage their crypto holdings for other investment opportunities.

Different types of stablecoins available in the market

Stablecoins have gained popularity in the cryptocurrency world as a means of providing stability to digital assets. There are several different types of stablecoins available in the market, each with its own unique characteristics and mechanisms for maintaining stability.

One type of stablecoin is the fiat-collateralized stablecoin, which is backed by a reserve of fiat currency such as USD or EUR. These stablecoins are relatively straightforward in their design, as the value of the stablecoin is directly tied to the value of the fiat currency that backs it. This type of stablecoin is popular among investors who are looking for a reliable and easily understandable asset in the crypto market.

Another type of stablecoin is the crypto-collateralized stablecoin, which is backed by a reserve of other cryptocurrencies. These stablecoins rely on smart contracts and collateralization mechanisms to ensure stability, and they are often seen as a more decentralized alternative to fiat-collateralized stablecoins. However, they also come with their own set of risks and complexities.

Finally, algorithmic stablecoins are a unique type of stablecoin that aim to maintain stability through algorithmic mechanisms and supply adjustments. These stablecoins do not rely on any external collateral, and instead use complex algorithms to control the supply of the stablecoin and stabilize its value. While this approach is innovative, it also comes with its own set of challenges and uncertainties.

Factors to consider when choosing a stablecoin for investment

When considering a stablecoin for investment purposes, it is crucial to evaluate the stability and security of the coin. Stability is vital as it ensures that the value of the stablecoin remains relatively constant, minimizing the risk of price volatility. This stability can be achieved through different mechanisms such as pegging the stablecoin to a fiat currency or using algorithms to maintain a stable value.

Another important factor to consider is the transparency and credibility of the stablecoin issuer. Investors should thoroughly research the background and reputation of the issuer to ensure that the stablecoin is backed by sufficient collateral and operates within regulatory compliance. Trust and reliability are key aspects when choosing a stablecoin for investment.

Furthermore, the liquidity of the stablecoin is an essential consideration. A stablecoin with high liquidity ensures that it can be easily bought or sold without significantly impacting its price. Liquidity also plays a crucial role in the stability and usability of the stablecoin in the market.

Lastly, investors should assess the use case and purpose of the stablecoin. Different stablecoins serve various purposes, such as enabling fast and low-cost cross-border transactions or providing a hedge against market volatility. Understanding the specific use case of a stablecoin can help investors determine its long-term potential and suitability for their investment portfolio.

The impact of stablecoins on the overall crypto market

Stablecoins have had a significant impact on the overall crypto market since their introduction. One of the key ways in which stablecoins have influenced the market is by providing a means for traders and investors to mitigate volatility. With the value of most cryptocurrencies fluctuating wildly, stablecoins offer a more stable alternative for storing value within the crypto market. This has led to an increase in the use of stablecoins as a trading pair and as a store of value within the crypto market.

Furthermore, stablecoins have also contributed to the expansion of the crypto market by providing a bridge between the traditional financial system and the crypto market. As stablecoins are pegged to traditional fiat currencies such as the US dollar, they provide an easy entry point for individuals and institutions looking to enter the crypto market. This has helped to bring in new capital and liquidity into the crypto market, leading to an increase in overall trading volumes and market activity.

Another impact of stablecoins on the overall crypto market is their role in enabling decentralized finance (DeFi) applications. Many DeFi platforms rely on stablecoins as a means of conducting transactions and providing liquidity. As a result, stablecoins have become an integral part of the DeFi ecosystem, contributing to its growth and expansion. This has led to stablecoins becoming a fundamental building block of the crypto market as a whole.

Overall, stablecoins have had a profound impact on the overall crypto market, from providing stability and liquidity to facilitating the growth of the DeFi ecosystem. As the crypto market continues to evolve, stablecoins will likely play an even greater role in shaping its future trajectory.

Frequently Asked Questions

What are stablecoins and what is their purpose?

Stablecoins are a type of cryptocurrency that are pegged to a stable asset, such as a fiat currency or a commodity. Their purpose is to provide the benefits of cryptocurrencies, such as fast and low-cost transactions, while also maintaining a stable value.

What are the advantages of using stablecoins for crypto investments?

Using stablecoins for crypto investments can provide protection against the volatility of the overall crypto market. It also allows for quick and seamless transfers between different exchanges and platforms, without the need to convert back to fiat currency.

What are the different types of stablecoins available in the market?

There are three main types of stablecoins: fiat-collateralized stablecoins, crypto-collateralized stablecoins, and algorithmic stablecoins. Each type has its own method for maintaining a stable value.

What factors should be considered when choosing a stablecoin for investment?

When choosing a stablecoin for investment, it is important to consider the stability of the underlying asset, the transparency and security of the issuer, and the liquidity and acceptance of the stablecoin in the market.

How do stablecoins impact the overall crypto market?

Stablecoins play a significant role in the crypto market by providing a more stable unit of account and a reliable store of value. They also facilitate trading and investment activities by reducing the need to cash out into traditional fiat currencies.

Are stablecoins suitable for long-term investments?

Stablecoins can be suitable for long-term investments, especially for investors who want to avoid the price volatility commonly associated with other cryptocurrencies. However, it is important to carefully evaluate the stability and credibility of the stablecoin issuer.

Can stablecoins be used for everyday transactions?

Yes, stablecoins can be used for everyday transactions, such as purchasing goods and services, sending money to friends or family, and even for remittances. Their stable value makes them a convenient and reliable means of exchange.

:max_bytes(150000):strip_icc()/terms_s_stablecoin_FINAL-89e1671b1f24486b84b74cebe6836573.jpg)