In recent years, the concept of tokenization has been gaining traction in the world of finance and investment. From real estate to fine art, tokenization is revolutionizing the way we think about and invest in real-world assets. In this blog post, we’ll explore the fundamentals of tokenization, the numerous benefits it offers, the current trends in the tokenization of real-world assets, and the implications it holds for investors. Additionally, we’ll delve into the regulatory challenges that come with tokenizing real-world assets and how they impact the industry. By the end of this post, you’ll have a comprehensive understanding of tokenization and how it is reshaping the investment landscape. So, let’s dive in and uncover the potential of tokenizing real-world assets.

Introduction to Tokenization

Tokenization is the process of converting rights to an asset into a digital token on a blockchain. This can include tangible assets such as real estate, artwork, or even commodities. Essentially, this process allows for the fractional ownership of these assets, making it more accessible to a wider range of investors. Tokenization has gained significant attention in recent years due to its potential to revolutionize the traditional financial sector.

One of the key benefits of tokenizing real-world assets is the increased liquidity it can provide. By turning physical assets into digital tokens, it becomes easier to buy, sell, and trade these assets on a secondary market. This potential for increased liquidity has led to growing interest from both institutional and retail investors.

Another important aspect of tokenization is the potential for increased transparency and security. Because transactions are recorded on a blockchain, there is a greater level of trust and verification in the ownership and transfer of these assets.

Overall, the introduction of tokenization has the potential to democratize investing and open up new opportunities for both investors and asset owners. As the technology continues to develop and regulatory frameworks evolve, we can expect to see even greater adoption of tokenization in the near future.

Benefits of Tokenizing Real-World Assets

Tokenizing real-world assets offers a range of benefits that can be advantageous for both investors and asset owners. One of the primary benefits is increased liquidity. By tokenizing an asset, it becomes much easier to buy and sell fractional ownership in the asset, allowing for a more efficient and liquid market. This can be particularly beneficial for illiquid assets such as real estate or fine art, which may take a long time to sell in traditional markets.

Another key benefit of tokenizing real-world assets is the potential for greater accessibility to a wider range of investors. By dividing an asset into tokens, it can be made available for purchase by a larger pool of investors who may not have had the financial means to invest in the entire asset. This democratization of access to assets can help to open up investment opportunities to a more diverse range of people.

Tokenization also offers the potential for increased transparency and security. Transactions on blockchain networks are typically recorded and immutable, which can provide a clear audit trail and reduce the risk of fraud or tampering. This can improve trust and confidence in the asset, making it more attractive to potential investors.

Finally, tokenizing real-world assets can also lead to cost efficiencies. By streamlining the process of issuing and trading tokens, it may be possible to reduce administrative and transaction costs associated with traditional asset ownership. This could result in lower barriers to entry for investors and potentially higher returns for asset owners.

Trends in Tokenizing Real-World Assets

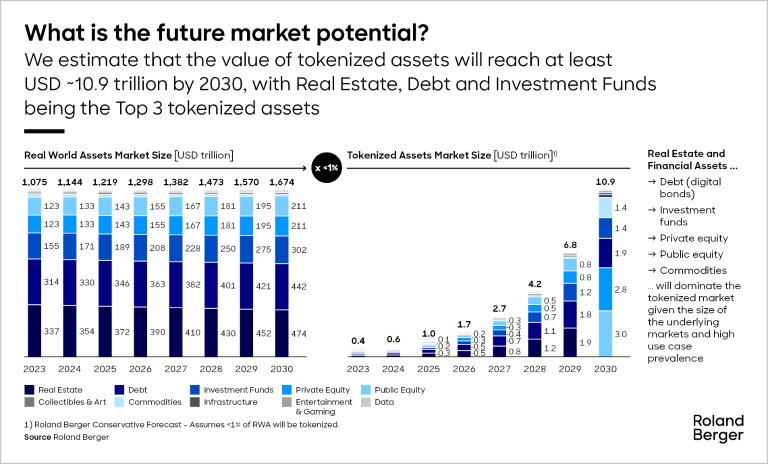

Tokenizing real-world assets is a growing trend in the financial industry, with more and more companies and investors looking to leverage the benefits of blockchain technology. One of the main trends in tokenizing real-world assets is the increased interest in alternative investments, such as real estate, art, and commodities. Investors are attracted to the potential for diversification and higher returns that tokenized assets can offer.

Another trend is the growing acceptance and adoption of security tokens as a way to represent ownership in real-world assets. This has led to the development of new token standards and protocols, as well as the emergence of new tokenization platforms and marketplaces. As the regulatory framework for security tokens continues to evolve, we can expect to see even more growth in this area.

One of the most significant trends in tokenizing real-world assets is the use of blockchain technology to increase transparency and liquidity in traditionally illiquid asset classes. By tokenizing assets, it becomes easier to buy, sell, and trade ownership stakes, leading to a more efficient and accessible market for investors.

Finally, a key trend in tokenizing real-world assets is the exploration of new use cases and applications for blockchain technology. This includes the potential for fractional ownership, automated compliance, and the integration of smart contracts to streamline transaction processes. As the technology continues to mature, we can expect to see even more innovative and impactful uses for tokenizing real-world assets.

Implications of Tokenization for Investors

Tokenization has become a popular method of investing in recent years, with real-world assets being converted into digital tokens. This method has significant implications for investors, as it provides them with the opportunity to invest in assets that were previously illiquid. By tokenizing real-world assets, investors can benefit from increased liquidity, fractional ownership, and access to a wider range of investment opportunities.

One of the key implications for investors is the potential for increased liquidity. Tokenization allows investors to buy and sell digital tokens representing real-world assets on secondary markets, providing them with the ability to exit their investments more easily. This increased liquidity can reduce the risk associated with investing in illiquid assets, as investors have the option to sell their tokens if needed.

Additionally, tokenization enables fractional ownership of assets, meaning that investors can purchase smaller amounts of assets that were previously only accessible to high-net-worth individuals or institutional investors. This opens up investment opportunities to a wider range of individuals, democratizing access to real-world assets.

Furthermore, the implications of tokenization for investors include access to a wider range of investment opportunities. By tokenizing real-world assets, investors can diversify their portfolios with assets such as real estate, art, or commodities, which may have been previously out of reach. This expanded access to investment opportunities can help investors to achieve greater portfolio diversification and potentially higher returns.

Regulatory Challenges in Tokenizing Real-World Assets

Tokenization of real-world assets offers many benefits, but it also comes with its fair share of challenges, particularly in the regulatory landscape. The traditional regulatory frameworks were not designed with tokenization in mind, which can pose significant hurdles for businesses looking to tokenize real-world assets.

One of the main challenges is the lack of clarity and consistency in regulation across different jurisdictions. The legal and regulatory requirements for tokenizing real-world assets can vary greatly from one country to another, creating a complex and uncertain environment for businesses operating in multiple locations.

Another challenge is the need for regulatory compliance, as businesses must navigate the complex web of laws and regulations to ensure that their tokenization efforts are in line with the relevant requirements. This can be a time-consuming and expensive process, especially for smaller businesses with limited resources.

Additionally, regulatory challenges in tokenizing real-world assets extend to investor protection and financial stability. Regulators are concerned about the potential risks associated with tokenization, such as fraud, money laundering, and market manipulation. As a result, businesses must demonstrate a robust compliance framework to address these concerns and ensure the safety and security of investors.

Frequently Asked Questions

What is tokenization of real-world assets?

Tokenization of real-world assets refers to the process of converting rights to an asset into a digital token on a blockchain. This allows for fractional ownership and trading of assets that were previously illiquid.

What are the benefits of tokenizing real-world assets?

Tokenizing real-world assets can improve liquidity, reduce transaction costs, and open up investment opportunities to a wider range of investors. It also provides transparency and security through the use of blockchain technology.

What are the current trends in tokenizing real-world assets?

Some current trends in tokenizing real-world assets include the tokenization of real estate, art, and other physical assets. There is also an increasing interest in Security Token Offerings (STOs) as a means of fundraising for businesses.

What are the implications of tokenization for investors?

Tokenization offers investors the opportunity to diversify their portfolios with fractional ownership of high-value assets. It also provides access to previously inaccessible markets and assets, potentially offering higher returns.

What are the regulatory challenges in tokenizing real-world assets?

Regulatory challenges in tokenizing real-world assets include issues related to securities regulations, ownership rights, and cross-border transactions. Governments are still navigating how to regulate and monitor tokenized assets effectively.

How does tokenization impact traditional asset markets?

Tokenization can disrupt traditional asset markets by increasing competition, lowering barriers to entry, and changing the way investors access and trade assets. It also has the potential to streamline processes and reduce reliance on intermediaries.

What are some potential future developments in tokenizing real-world assets?

Potential future developments in tokenizing real-world assets include the integration of smart contracts, advancements in token standards, and the emergence of new asset classes being tokenized, such as intellectual property or commodities.